What are exchange traded fund?

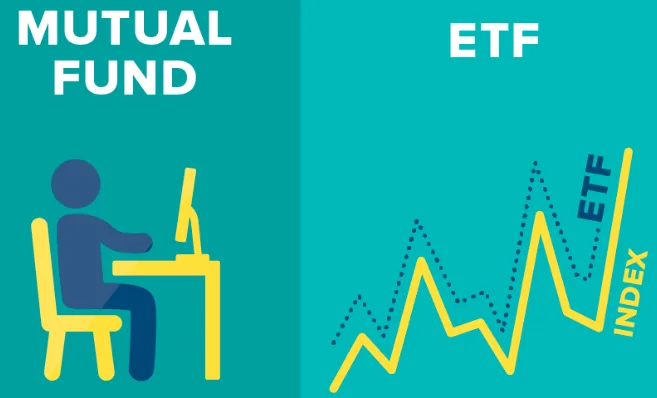

ETF or exchange traded funds are mutual fund schemes which track a market benchmark index like Sensex, Nifty etc. ETF schemes invest in a basket of securities which replicate the benchmark index they are tracking. ETFs do not aim to beat the market benchmark index; they simply aim to track the index.

What are active mutual funds?

Active mutual funds are financial instruments which invest in a portfolio of securities which may be stocks, bonds, Government securities, money market instruments, gold, silver and real estate investment trusts (REITs) etc. depending upon the type and category of scheme.

In India, actively managed mutual fund schemes dominate the fund industry. In fact, actively managed mutual fund investments account for around 85% of the total assets under management (AUM) as per AMFI data as on 28th February 2023.

Actively managed mutual funds are managed by professional fund managers with an aim to beat the market benchmark index with which they benchmark the respective schemes. In other words, the actively managed mutual fund managers endeavour to provide investors with returns higher than that of the returns of the benchmark. This requires considerable effort and resources for research, fundamental analysis, investment strategies, risk management etc.

Since the effort and resources for research and analysis including fund management is higher in actively managed mutual fund schemes compared to the exchange traded funds, the total expense ratios (TERs) of actively managed mutual funds are higher.

ETF versus active mutual funds

Let us now compare the ETF and active mutual fund investments based on the following criteria:

Cost – The fund management cost of ETF is much lower than actively managed mutual funds. This is because active funds aim to outperform the return of the benchmark indices, whereas the ETF aims to replicate the index returns.

Risk – Active mutual funds have market risk as they may invest aggressively across companies and sectors to generate higher returns. Whereas an ETF invests in the same stocks and in the same proportions as in the benchmark Index it is following as it must just replicate the index returns. Index funds do not aim to generate alpha and thus it is less risky compared to active mutual fund schemes.

Alpha generation – Actively managed mutual fund schemes aim to beat the market benchmark index and create excess risk adjusted returns of the fund relative to the market benchmark index it is following. ETF on the other hand, do not aim to generate alphas – they simply aim to track the market benchmark index and replicate its returns. Alpha is essentially the potential higher returns; which investors expect as they pay higher costs in an actively managed fund compared to an ETF.

Should you invest in ETF or active mutual funds?

For a prudent investor, it makes sense to have a mix of both, ETF and active mutual funds in their investment portfolio. ETF may be more suitable to get market like returns, say NIFTY or Sensex. Whereas actively managed funds may be suitable for market segments where the fund managers have a higher potential of generating alphas for investors, like mid and small cap mutual fund scheme.

The mix of index funds and active funds should also depend on the risk appetite of the investors. Investor must consult with their financial advisor or mutual fund distributor to make informed investment decisions.