Before understanding the functions of payroll companies, it is important to ensure that you’ve understood the concept of payrolls themselves.

What Are Payrolls? What Are The Elements It Incorporates?

Payroll within a corporation is the compilation of all the accounting statements of the salaries, benefits, bonuses, and deductions of their workers.

In finance, the word payroll means the amount paid out to workers over a specified period of time for the work they have performed for the company.

Payroll is critical in accounting since payrolls (even payroll taxes) significantly influence most corporations ‘net profits. Also, Payroll is frequently subject to various laws and regulations with which businesses should comply.

Following are the elements that payroll consists of.

Working Hours

When you have hourly staff you will keep track of the hours they work. It will ensure you pay the right amount to your workers.

When you have compensation workers, you should keep a track of the hours they’re working to ensure they’re putting in their entire time. You would also want to chart the holiday, sick days and vacation time your workers take off from work.

Wages And Salary

A salary is a fixed sum which an employee will receive. An employee is usually given an annual wage, which is then divided by the number of pay periods during the year.

Compensation is what you’re paying an employee depending on the hours worked. For every hourly employee, you’ll set a different pay rate. To measure the gross wages of an employee, you multiply the pay rate by the hours that the employee works.

There are other expenses that the employer must be mindful of like overtime pay, if the employee works extra hours or days then he must be compensated for it. Also, you have to make sure you have followed all the laws pertaining to it.

Deduction

Deduction refers to any money that you remove from the gross compensation of an employee.

They must subtract payroll taxes from every employee’s salaries. The amount that you hold from each worker varies based on the overall earnings and the details on Form W-4.

Payroll taxes include federal municipal income tax, income tax, state unemployment tax, federal unemployment tax, social security tax, and Medicare tax

A garnishment is a post-tax deduction that is mandated by the judge. A garnishment helps to pay back the unpaid debt of an employee.

You may be told to withhold money from the salary of an employee to pay for unpaid taxes, defaulted loans, and insufficient child care. If you decide to subtract a garnish, a court will give you a note.

Net And Gross Pay

You’ll see the net and gross compensation of an employee on a payslip. Gross payment is a cumulative wage for an employee. Usually, IRS forms request for gross compensation for a worker.

Net pay is a salary for an employee after subtracting all deductions. Net pay is the take-home salary for an employee. Financial institutions and other suppliers of loans generally choose to learn about somebody’s net income.

Options For Processing Payrolls

Payroll Accountant

Payroll outsourcing to a payroll accountant could free up some of your time and energy. The accountant will look after you in the payroll process. That choice may be the most costliest.

Manual Payroll

You’ll need to know how to make the payroll. This alternative will be the one that will take the most time. The IRS also gives tax tables which you can use to evaluate the federal withholding tax.

Payroll Software

Almost all payroll management software are free. Payroll software streamlines a lot of the payroll plan, which ensures the time spent on doing the payroll is significantly reduced.

Business payroll software will measure salaries and taxes and some will even give you the taxes. Hence, it is safe to say that payroll software for small businesses can be quite helpful without costing much. For companies that also employ overseas, partnering up with an EOR that offers global payroll services is the best and easiet way to handle all employment and payroll related processes.

What Is Payroll Software?

Payroll administration is one of the company’s most important business processes, and one of the most difficult and time-consuming day-to-day tasks. This doesn’t produce direct sales but holds this phase to a bare minimum in terms of time and expense, which means saving the company time and increased productivity.

Payroll software is a prime work tool with reduced time consumption and easy activities to run. The payroll program is typically used on the basis of employment to pay the total sum to the employee, as well as maintaining the employee record of salaries, bonuses, deferred taxes, and salaries.

Payroll software is important because it influences the net profit of the company otherwise there would be increased chances of error when manually holding records.

Best Software For Payroll Processing

Listed below are some of the leading payroll software for small businesses.

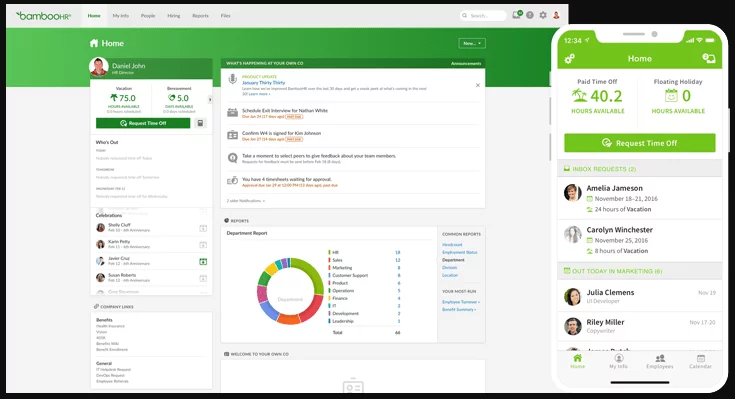

BambooHR

BambooHR is the concept of a comprehensive payroll control system combined with the Human Resource Information System. It provides for small and medium-sized enterprises.

It has a versatile core system and pricing structure bundled with personalized features, allowing users to set fields, tables, and tabs, create groups, and incorporate with related systems such as applicant tracking and payroll.

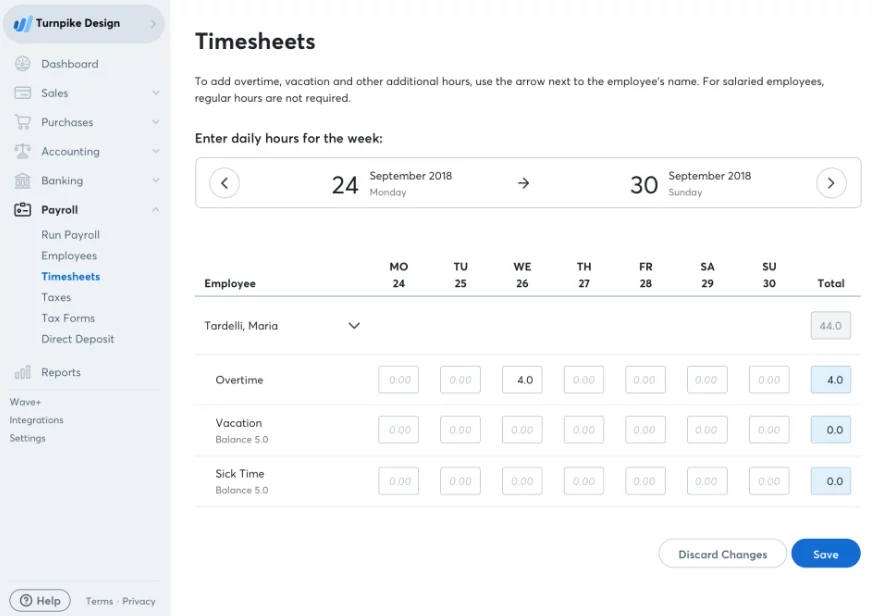

Wave

Wave is a free online accounting for small businesses with professionally crafted invoices, forecasts, and receipts. Being another dependable Xero option, the alternative provides payments by credit card, revenue, and expense tracking and pay stub payroll.

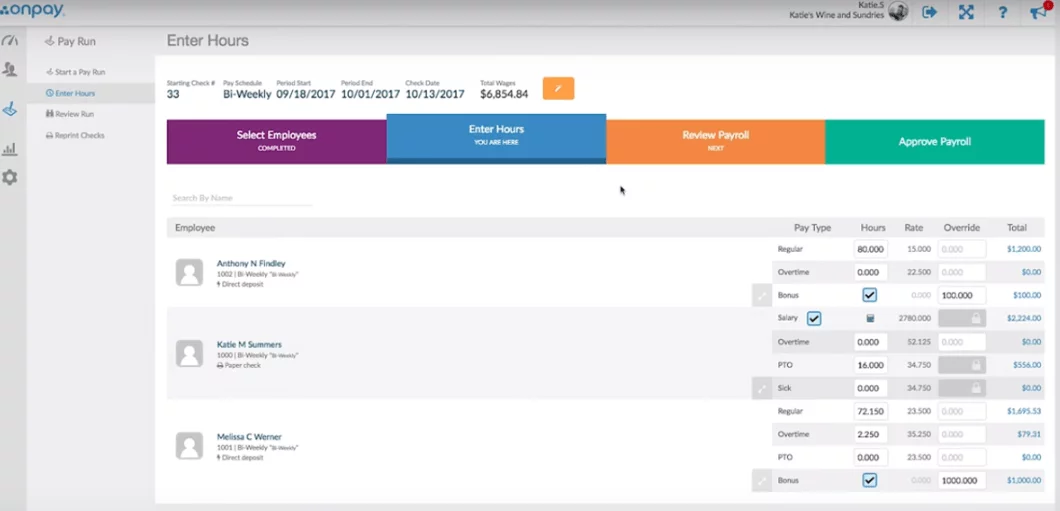

OnPay

OnPay is a strong but simple-to-use payroll app for medium and small-sized companies. This system will correctly measure the federal and state payroll tax, make tax payments, and file tax forms.

The vendor should be sure of their accuracy and they will be responsible for any tax filing mistakes. OnPay stores the information securely, manages the payrolls with efficiency and optimizes selective operations and tasks.