A vendor take-back mortgage involves the seller extending a loan to the buyer of the property for a certain amount of the purchase price. A vendor take-back mortgage is designed to help move homes during difficult times.

Both real estate investors and homeowners can benefit when the market is particularly challenging. The seller will essentially lend a sum of money to the buyer so that they can afford to buy the home from them.

However, it should be noted that the interest rate the buyer will need to pay in order to obtain the loan will typically be higher than the rate issued on a conventional mortgage.

A traditional mortgage is also issued by a financial institution, such as a bank. With a vendor take-back mortgage, the lender is actually the homeowner. As such, if the buyer were to foreclose on the home, then the seller would be able to evict the buyer and put the home back on the market.

What is a vendor take-back mortgage?

A property owner may provide the homebuyer with a loan so that they can buy the property from them. A property owner may also provide the buyer with the loan because they may be having trouble selling their home via the traditional way.

Moreover, because of the added risk that the owner takes on by providing the buyer with the sum of cash, the interest rate will be higher than the rate issued by most banks. The homeowner can also evict the buyer if they are unable to fully pay off their mortgage.

The homeowner can then choose to move back into the home or try to sell it to someone else.

How do vendor take-back mortgages work?

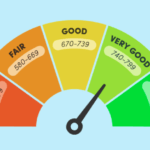

A homebuyer who is struggling financially may not be able to secure the funding that they need from a bank in order to buy the home that they want. They may have a bad credit score or maybe unable to put down the necessary down payment without having to pay mortgage insurance.

As such, they may need to turn to a vendor take-back mortgage, which is sometimes known as a seller take-back mortgage, in order to buy a home above and beyond their bank-determined purchasing limit.

As for the seller, they may have tried traditional channels in order to sell their home but may have failed to sell their property due to a challenging real estate market.

For example, the seller may be trying to sell their home during a recession or during a period of hyperinflation. The loan that the seller extends to the buyer will be for a portion of the sales price.

The home seller will still retain equity and will continue to own a percentage that is equivalent to the loan amount until the mortgage is completely paid off. It should also be noted that a vendor take-back mortgage may be a secondary lien on the home.

In other words, the homebuyer may already have a main funding source, such as a bank. The second lien is designed to ensure that the borrower gets enough money to buy the property.

One of the crucial benefits for sellers who provide their clients with vendor take-back mortgages is they can generate money from the high interest that they charge on the loan.

One key difference between a traditional mortgage and a vendor take-back mortgage is that the interest rate tends to be higher with a vendor take-back mortgage. Most vendor take-back mortgages will be issued alongside a conventional mortgage.

The home seller will use the home as a form of collateral for the loan. This ensures that they can then make a claim on the property in the event that the buyer defaults on their mortgage.

The mortgage procedure can be complicated, so working with a mortgage broker can help facilitate the process.

Benefits of a Vendor Take-Back Mortgage

For the seller, they may make a property that is difficult to sell more desirable to prospective buyers. They also get to charge an elevated interest rate, while enjoying a steady flow of cash in the process. Furthermore, a vendor take-back mortgage serves as a notable asset for the seller.

There is also the possibility for a deferral or tax savings for the seller. In regards to buyer benefits, the loan will not appear on their credit score.

What’s more, financing is also readily available to the buyer, and, in some cases, the interest rate may actually be lower than what’s available on the market. Best of all, a vendor take-back mortgage allows the buyer to close a deal that they would otherwise be unable to.

Going All In

To sum up, a seller should consider a vendor take-back mortgage if they are unable to sell their home due to difficulties in the real estate market. A buyer should consider a take-back mortgage if they are unable to obtain financing solely through traditional channels, such as a bank.