Every citizen of our country who falls within the Income Tax limits pays the taxes and by the end of financial year a lump sum amount from our income is contributed towards the Income tax. We also file Income Tax Returns to claim income tax refund.

Income Tax Refund – How to Claim & Check Refund Status

ITR claim is not just required to claim the refund amount from taxes if any but the ITR filing is needed in many transactions including buying and selling properties where these documents are checked.

However, most of us are not sure about the process of claiming ITR. An individual is eligible to receive ITR when the amount for tax paid to the government is more than the actual tax liability.

This happens when the self-assessment paid or TDS deducted of the payee is higher than the total. It is important to file Income tax refund in such cases.

Steps to claim Income Tax Refund Online

The ITR department helps to return any excess tax amount that is paid by a tax payer and this refund order is issued by ITR department only after a proper verification of circumstances and facts produced by the payee.

You can also take tax refund guide by finances rule in case of any doubt, query, or help. Here are steps for getting income tax refund properly.

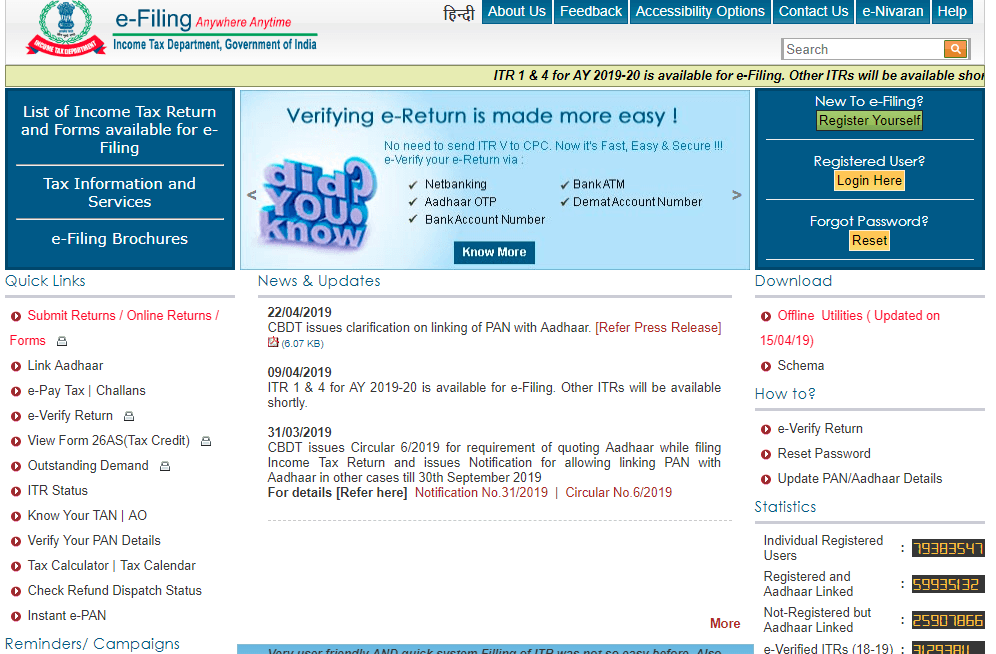

- Fill your Income Tax return online by going to the official website.

- Click on ‘Login’ option and enter the details line PAN, your password and Captcha code for authentication. Once you are logged in, click on the e-file option and select Income Tax return.

- With this, a new window opens up with your PAN card details auto filled. You will have chosen assessment year from drop down menu options ITR1 for the ITR and submission mode as Prepare and submit online.

- Once you fill the required details you will be asked to choose to how you wish for verification, i.e. Aadhaar Card or EVC.

- You will then be redirected t PART A of the form where you have to give general details name, PAN number, surname etc. Some details are auto populated and you have to validate them.

- You can save a draft and validate the details and fill in missed out details like Aadhaar number, address etc. if any. You can then go to next section PART B. Here you have to fill details about your income details like property, salary details, etc. and then you validate both PART A and B and submit the form.

- On submission of the form you shall receive an acknowledgement number for filing the tax return online with your digital signatures.

- You can do a physical signature also in the UTR-V form which is generated online and submit in the income tax processing center within 120 days of return filing.

- If you have filled the income tax form online and clicked on the validate button on the same sheet, the system will automatically calculate the refund amount which is due to you depending upon the data entered by you. The refund amount shows in the Refund row.

- Please ensure that the excess tax paid by you is also reflecting in the Tax Credit statement form which is 26SA to get the refund.

The process of filing a request for income tax refund online is very simple and quite easy for anyone. After successfully filing the request, your online application request will be sent to the IRS department.

They will check your filed details. Once IRS department will accept your returns, they will process your income tax refund and you will get it back within 7-10 days.

2 Comments

Thanks, this article help me to get income tax refund.

Useful and much needed information is shared in this blog regarding Income tax refund.